BlackRock CEO Larry Fink has expressed his support for cryptocurrencies as a transactional currency spanning borders, insisting it will democratise investing worldwide and highlighting the increasing interest among the company's clients in digital assets.

During an interview on CNBC's Squawk on the Street on Friday, Fink said, "More and more of our global investors are asking us about crypto."

BlackRock, an asset manager with over $8 trillion in assets across various investment products, has witnessed a surge in inquiries regarding cryptocurrencies.

Fink believes that cryptocurrencies offer a unique value proposition compared to other asset classes, particularly in terms of portfolio diversification.

"It's so international it's going to transcend any one currency," he noted.

While Fink expressed his positive stance on cryptocurrencies during the interview, he refrained from commenting on BlackRock's application for a Bitcoin exchange-traded fund (ETF) in the United States. The application is currently pending with the Securities and Exchange Commission (SEC). Fink stated that BlackRock is working closely with regulators to ensure the safety and security of any product bearing the company's name.

In the past, the SEC has rejected several applications to list Bitcoin ETFs on the spot market. However, BlackRock's filing has sparked renewed optimism for imminent approval due to the company's successful track record in obtaining ETF approvals. According to Bloomberg Intelligence analysts Eric Balchunas and James Seyffart, BlackRock has filed 550 ETF applications and has only faced one rejection.

"We believe we have a responsibility to democratise investing. We've done a great job, and the role of ETFs in the world is transforming investing. And we're only at the beginning of that," Fink said in the interview.

Following BlackRock's application, other asset managers, including Fidelity, Bitwise, 21Shares, WisdomTree and Investco, have also submitted refilings for similar ETF products in the United States.

ADNOC Drilling awarded AED6.24bn contract to unlock UAE’s unconventional energy resources

ADNOC Drilling awarded AED6.24bn contract to unlock UAE’s unconventional energy resources

EHRDC offer 50 private-sector job opportunities for Emiratis

EHRDC offer 50 private-sector job opportunities for Emiratis

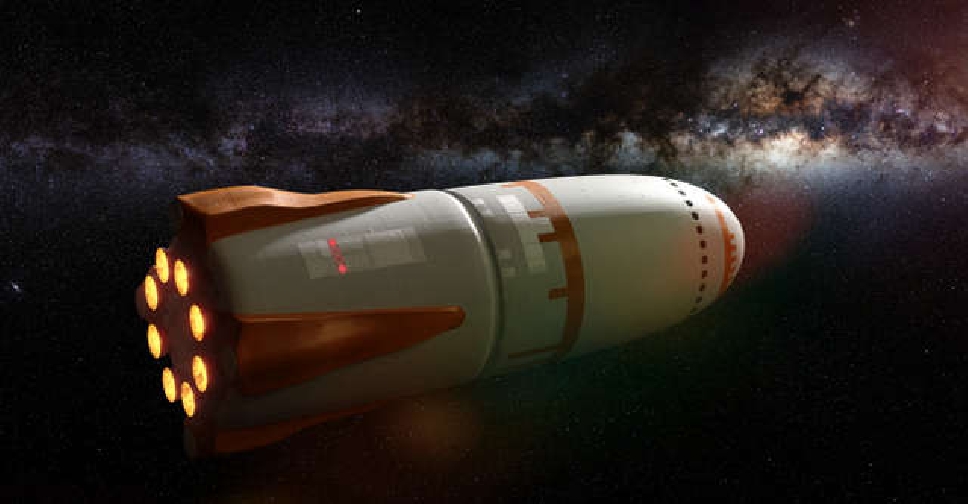

Tokyo startup to develop reusable rocket

Tokyo startup to develop reusable rocket

OpenAI strikes deal to bring Reddit content to ChatGPT

OpenAI strikes deal to bring Reddit content to ChatGPT