Dubai Electricity and Water Authority's (DEWA) Initial Public Offering (IPO) opened for subscription on Thursday.

The price range has been set at between AED 2.25 and AED 2.48 per share, implying a market capitalisation of between AED 112.5 billion (US$ 30.63 billion) and AED 124 billion (US$ 33.76 billion), which would make DEWA the largest company on the Dubai Financial Market by market capitalisation.

A total of 3.25 billion shares, equivalent to 6.5 per cent of DEWA’s existing shares, will be offered, with the Selling Shareholder reserving the right to increase the size of the offering.

The IPO subscription period starts today and runs until April 2 for retail investors and until April 5 for qualified investors.

The final offer price will be determined through a book building process and is expected to be announced on April 6, while the admission of the shares to trading on the DFM is expected on April 12, subject to market conditions and obtaining relevant regulatory approvals in the UAE.

Emirates Investment Authority, ADQ, UAE Strategic Investment Fund, Multiply Group, Alpha Dhabi Partners and Investment Holdings Est. are to become cornerstone investors in the IPO with a total commitment of up to AED 4.7 billion.

Dubai Electricity and Water Authority PJSC announces offer price range and start of the subscription period for IPO. https://t.co/dwqEsBzVjKhttps://t.co/sdP2MqQwdO

— Dubai Media Office (@DXBMediaOffice) March 24, 2022

China, ASEAN to submit upgraded free trade deal to leaders in October

China, ASEAN to submit upgraded free trade deal to leaders in October

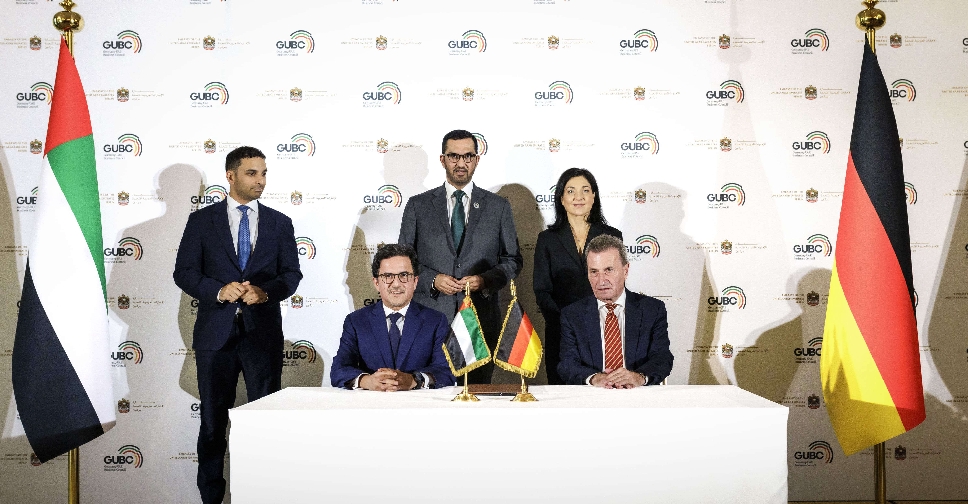

UAE, Germany launch joint business council

UAE, Germany launch joint business council

Trump puts 35% tariff on Canada, eyes 15%-20% tariffs for others

Trump puts 35% tariff on Canada, eyes 15%-20% tariffs for others

UAE committed to achieving planned oil production capacity

UAE committed to achieving planned oil production capacity