Dubai consolidated its status as the world’s leading foreign direct investment (FDI) hub, retaining its first rank globally for attracting FDI projects during H1 2022.

In a record first-half achievement for the emirate, Dubai attracted 492 FDI projects during the first six months of 2022, an 80.2 per cent increase compared to the same period in 2021, according to data published by Dubai’s Department of Economy and Tourism (DET).

Dubai also ranked first globally in attracting greenfield FDI projects during the same period this year, according to the Financial Times Ltd’s ‘fDi Markets,’ the most comprehensive online database on cross-border greenfield investments.

Greenfield projects accounted for a 56 per cent share of Dubai’s FDI projects during the period, according to the Dubai Investment Development Agency (Dubai FDI), a DET entity, using data from its Dubai FDI Monitor.

Dubai witnessed FDI inflows of AED13.72 billion ($3.73 billion) in H1 2022, reflecting a growth of 14.6 per cent compared to the same period last year.

Meanwhile, FDI investments and projects generated 15,164 new jobs in H1 2022, a 33.5 per cent year-on-year growth compared to H1 2021, with Dubai retaining its top rank in FDI-related employment among countries in the Middle East and North Africa (MENA).

Underlining its focus on retaining investments and investor confidence, Dubai ranked fourth globally in reinvestment FDI projects, 10th globally in reinvestment FDI capital inflows, and eighth in terms of jobs created by reinvestment projects.

Dubai ranked first globally in attracting greenfield FDI projects in 2021, with 418 greenfield FDI projects, and the latest numbers vindicate its business-friendly initiatives and policies.

"Dubai’s record FDI inflows and consistent top rankings testify to investor confidence in its economic stability and bright growth prospects and reinforce its status as a strategic partner to foreign investors," said His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of The Executive Council of Dubai.

"Further diversifying the economy, attracting more investment in future-focused sectors, and enhancing growth opportunities in the digital economy will remain our strategic objectives for Dubai’s development journey," he added.

.@HamdanMohammed: The new global & regional FDI milestones are aligned with the directives of @HHShkMohd to make #Dubai the world’s best city to live, work and invest. The progressive vision & farsighted policies of His Highness have made Dubai a magnet for foreign investment. pic.twitter.com/aY2gAgxm1c

— Dubai Media Office (@DXBMediaOffice) October 31, 2022

While 56 per cent of the FDI projects that came into Dubai in H1 2022 were greenfield projects, 29 per cent belonged to the category of new forms of investment, 6 per cent were VC-Backed FDI projects, 5 per cent were mergers and acquisition (M&A) projects, 3 per cent were reinvestment, and 1 per cent, joint ventures.

Top source markets and sectors

The United Kingdom (36%), the United States (20%), France (10%), Singapore (5%), and Switzerland (4%) were the top source countries for FDI capital in Dubai during the first half of 2022.

In terms of FDI projects, the top five source markets were the US (18%), the UK (15%), India (13%), and Singapore and France (4% each).

The five most prominent sectors in terms of FDI capital inflows to Dubai in the first half of 2022 were Speciality Trade Contractors (28%), the Non-Residential Building Construction sector (12%), Accommodation and Food Services (12%), Data Processing, Hosting and Related Services (6%), and Electric Power Generation (4%).

The Wholesale and Retail Trade sector and the Accommodation and Food Services sector topped the list with 11% each in terms of the number of FDI projects, followed by the Computer Systems Design and Related Services sectors, Software Publishing, and Administrative and Support Services, with 7% each.

#Dubai consolidated its status as the world’s leading foreign direct investment (FDI) hub, retaining its first rank globally for attracting FDI projects during H1 2022.https://t.co/kxR28vZq3r pic.twitter.com/usJuEG1Jub

— Dubai Media Office (@DXBMediaOffice) October 31, 2022

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

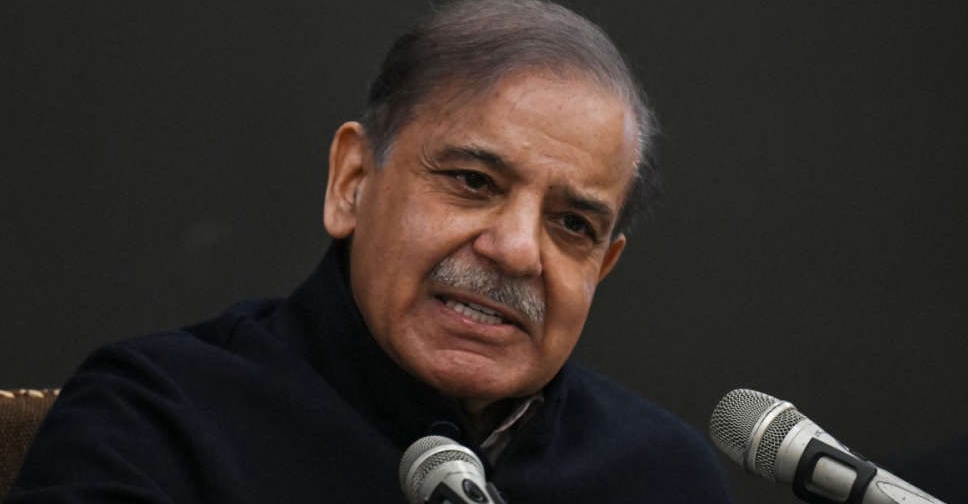

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif