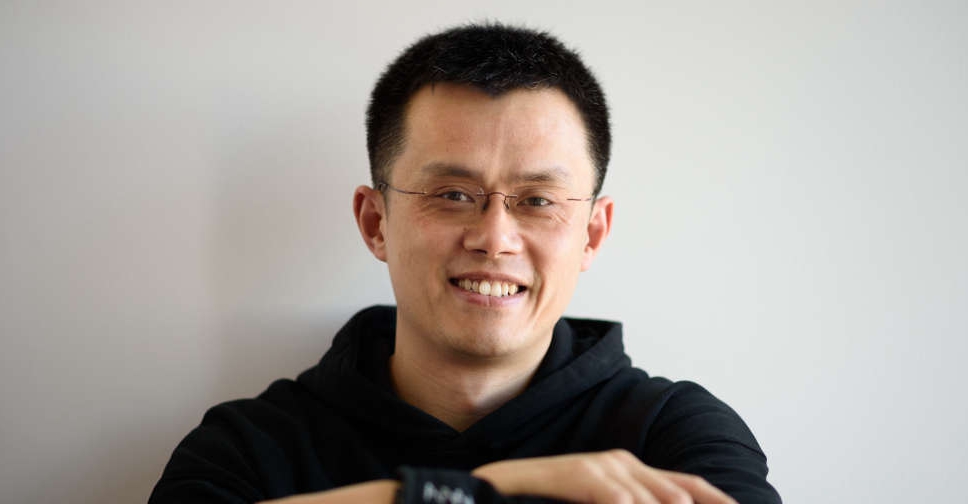

The Securities and Exchange Commission (SEC) has taken legal action against cryptocurrency exchange Binance and its founder Changpeng Zhao.

The regulator has filed 13 charges, accusing the company and Zhao of commingling billions of dollars' worth of user funds and transferring them to a European firm controlled by Zhao.

According to the SEC, Binance and Zhao deliberately circumvented their own controls to allow high-net-worth investors and customers from the United States to continue trading on Binance's unregulated international exchange. The complaint highlighted an instance where a senior executive of the company referred to Binance as an "[expletive] unlicensed securities exchange in the USA".

The allegations further assert that Binance created its subsidiary, Binance.US, as a shield to protect the main company, and Zhao effectively concealed their actions and hoodwinked law enforcement efforts.

The SEC claimed that two former CEOs of Binance.US expressed deep concern over Zhao's level of control and even testified before federal regulators. While their names were not disclosed in the complaint, the first and second CEOs of Binance.US were identified as Catherine Coley and Brian Brooks.

One former CEO, referred to as "BAM CEO B," testified to the SEC, stating, "I'm not actually the one running this company, and the mission that I believe I signed up for isn't the mission. And as soon as I realised that, I left."

The SEC complaint revealed that Binance generated $11.6 billion in revenue, primarily from transaction fees, between June 2018 and July 2021. The exchange has allegedly worked, initially overtly and later covertly, to attract customers from the United States, under the direction and control of founder Changpeng Zhao.

Despite knowing that tens of thousands of customers were based in the US, the SEC claimed that Binance chose not to take appropriate action, disregarding federal laws that prohibit the unregistered offer and sale of securities. The SEC further contended that Binance's compliance efforts in 2019 were largely a public façade.

The complaint alleged that Zhao instructed the creation of an evasion plan for high-net-worth customers, which involved using a VPN service to hide their US locations and submit compliance documents to obscure their country of origin.

Previous media reports detailed how Binance employees encouraged users to bypass the exchange's "know your customer" systems using VPNs.

"We do need to let users know that they can change their KYC on Binance.com and continue to use it. But the message needs to be finessed very carefully because whatever we send will be public. We cannot be held accountable for it," Zhao allegedly told his top team in 2019.

The SEC also accused Binance and Zhao of using market-making companies, Merit Peak and Sigma Chain, to manipulate trading prices and profit from their customers. These companies allegedly acted as "market makers" for Binance's platforms, ensuring availability to fill customer orders for buying or selling crypto assets. However, the SEC highlighted multiple issues with the roles of these companies, including the fact that they were beneficially owned by Zhao and mixed customer funds with Binance's funds, similar to allegations against bankrupt crypto exchange FTX.

Of great concern to investors, the SEC claimed that Binance and Zhao engaged in "wash trading," artificially inflating the prices of crypto assets by trading with themselves. The complaint stated that Sigma Chain collected $190 million for Zhao, and a significant portion of these funds was used to purchase a yacht.

In response to the charges, Zhao took to Twitter and dismissed them by posting "4," which is a common refrain within the Binance community, urging users to ignore fear, uncertainty and doubt (FUD).

This latest complaint comes after the Commodity Futures Trading Commission filed similar charges against Binance, alleging the exchange's failure to prevent US customers from accessing its services.

"We will issue a response once we see the complaint," Zhao stated on Twitter. "Media gets the info before we do."

In a subsequent blog post, Binance expressed disappointment with the SEC's decision to file a complaint, stating that the company had actively cooperated with the investigations and engaged in extensive discussions to reach a negotiated settlement.

SEC Chair Gary Gensler commented on the charges, saying, "Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law."

EHRDC offer 50 private-sector job opportunities for Emiratis

EHRDC offer 50 private-sector job opportunities for Emiratis

Tokyo startup to develop reusable rocket

Tokyo startup to develop reusable rocket

OpenAI strikes deal to bring Reddit content to ChatGPT

OpenAI strikes deal to bring Reddit content to ChatGPT

Emirates set to resume Nigeria flights

Emirates set to resume Nigeria flights