As India drags the U.S. before the World Trade Organisation over a spike in American visa fees for foreign workers, the stakes go well beyond the few thousand dollars required for paperwork. It’s the first time that two countries have clashed over visas at the international trade arbiter and reflects the changing nature of global commerce. India generates more than $100 billion from a services industry that depends on sending citizens to the U.S. and other countries to develop software, set up computing systems and repair broken technologies. It argues the U.S. move to double the cost of visas for these skilled workers constitutes protectionism and violates the WTO’s principles for fair trade. The U.S. contends the policy is more about immigration than trade. The visa program has generated controversy because of concerns it is used to replace American workers with lower cost employees from abroad. It has become a hot-button issue in the U.S. presidential campaign, drawing fire from candidates including Donald Trump. “This is a landmark dispute, irrespective of the outcome,” said Atul Sharma, the Geneva-based managing director and WTO specialist at law firm Lakshmikumaran & Sridharan. Fees Double The clash arose from U.S. legislation that sharply raises the amount companies have to pay for two categories of visas. The H-1B temporary visas for skilled workers are doubling to $4,000 per application as of April 1, while L-1 visa applicants will have to pay $4,500. Although India isn’t mentioned by name, it’s the biggest users of such visas. Companies such as Infosys Ltd., Wipro Ltd. and Tata Consultancy Services Ltd. apply for up to 65,000 H-1B visas each year. The fee hikes apply only to companies that have more than 50 workers in the U.S. and where 50 percent of these workers are foreign nationals. The dispute threatens India’s most valuable export. The country has become a tech services powerhouse and sends thousands of technology professionals on temporary assignments to countries around the world. The U.S. accounts for 61 percent of the country’s $108 billion information-technology services revenue. $400 Million The National Association of Software & Services Companies, the industry’s trade group, estimates Indian IT firms will bear an additional $400 million in annual costs under the new policies. “The fees alter the playing field for our companies,” said Shivendra Singh, vice president and head of global trade development at Nasscom. C.P. Gurnani, managing director and chief executive officer of Tech Mahindra Ltd., India’s fifth-largest IT services firm, says the visa charges could end up hurting American companies. Customers benefit from his industry’s support because they can reduce expenses and restructure more easily. The legislation will be “counterproductive,” said Gurnani, whose clients include Cisco Systems Inc. and Bridgestone Corp. U.S. technology companies such as Cisco and Facebook Inc. have voiced support for the visa programs, contending they bring talented workers into the country and help the country’s economy. They have argued for lifting the cap on high-skill visas. Sending a Message The WTO pushback could be preventative. India may be disputing the visa fees at the trade group in an attempt to avoid more serious restrictions on high-skill visas, said Ron Hira, an associate professor of political science at Howard University. “I think this is more about sending a message,” he said. Both Republicans and Democrats in the U.S. presidential campaign have bashed the H-1B program. Trump has accused Indian IT firms of hoarding H-1B visas and using them to replace Americans workers. He called the system a "cheap labor program." In a statement this month, Arvind Subramanian, the chief economic adviser to India’s Finance Ministry, said Trump’s statements on eliminating visas for high-skilled Indian workers pose a threat to India’s growth model. "Playing With Fire" Hira says the WTO case could prove dangerous for the tech services firms. If India wins the case, U.S. officials may decide they should impose stricter visa rules, he said. For example, some in Congress have argued companies that want H-1B visas should be required to demonstrate there are no qualified American workers available first. “I think they’re playing with fire,” Hira said. It’s not clear which country will prevail. Hira said the U.S. will likely be allowed to keep control over such visa fees. J.P. Singh, a distinguished senior fellow at George Mason University’s School of Policy, Government and International Affairs, said India’s argument has “great merit.” The U.S. said it is looking forward to discussing its H-1B visa program. “We are confident that the United States’ visa program, which was recently updated on a bipartisan basis by Congress, is fully consistent with our WTO obligations,” said Andrew Bates, a spokesman for the U.S. Trade Representative. The two countries are preparing for bilateral discussions, probably in Geneva where the trade dispute arbiter is based. If they can’t reach an agreement within 60 days of India’s March 3 complaint, it can ask the WTO to establish a panel to review the matter. The issue may well not be resolved until after the U.S. presidential election. “The WTO consultations, the panel ruling, the informal arbitration, and the appellate body ruling could drag the case for a very long time,” said George Mason’s Singh. (By Saritha Rai/Bloomberg)

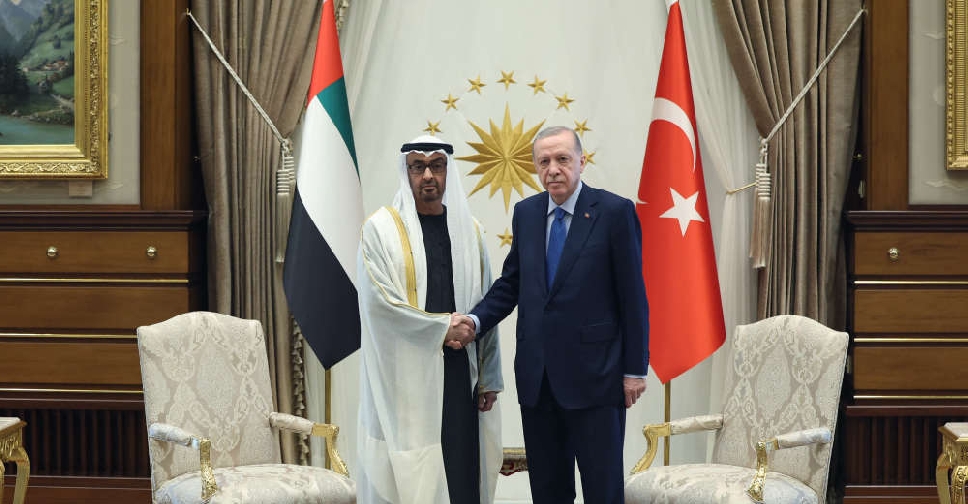

New UAE–Turkey MoUs expand strategic partnership

New UAE–Turkey MoUs expand strategic partnership

Ministry of Finance launches 2027–2029 budget cycle

Ministry of Finance launches 2027–2029 budget cycle

Tesla to sell Model Y cars in India, starting at $69,770

Tesla to sell Model Y cars in India, starting at $69,770

Wizz Air to exit Abu Dhabi operations

Wizz Air to exit Abu Dhabi operations