A dirham-denominated Islamic Treasury Sukuk (T-Sukuk), with a benchmark auction size of AED 1.1 billion, has been launched by the UAE.

The Sukuk is represented by the Ministry of Finance (MoF) as the issuer in collaboration with the Central Bank of the UAE (CBUAE) as the issuing and paying agent.

Mohamed bin Hadi Al Hussaini, Minister of State for Financial Affairs, highlighted the UAE's keenness to strengthen and build a pioneering investment infrastructure to boost the Islamic economy as one of the key pillars of the national economy.

“The Ministry of Finance cooperates with all its partners, foremostly the Central Bank of the UAE, to attract investments and deploy them in Islamic economy channels. The T-Sukuk are Sharia-compliant financial certificates, and they will be traded to reflect the local return on investment, support economic diversification and financial inclusion, and contribute to achieving comprehensive and sustainable economic and social development goals,” he said.

Additionally, he emphasised that issuing the T-Sukuk in AED will contribute to building a local currency bond market, diversifying financing resources, boosting the local financial and banking sector and providing safe investment alternatives for local and foreign investors.

He also said it will help build the UAE Dirham-denominated yield curve, thereby strengthening the local financial market and developing the investment environment.

Khaled Mohamed Balama, Governor of CBUAE, said it will "contribute to the implementation of the new Dirham Monetary Framework (DMF) and support ongoing work to establish the Dirham risk-free pricing benchmark (yield curve), which would stimulate more domestic market activities to support the sustainability of the country's economic growth."

The T-Sukuk will be issued initially in 2/3/5-year tenures, followed by a 10-year sukuk later, and will be denominated in UAE dirhams to develop the local bonds debt market and help develop the mid-term yield curve.

The structuring of Islamic Sukuk has been approved by the Higher Shari'ah Authority at the CBUAE, which cooperates with the relevant authorities to standardise and unify the practices of Islamic financial institutions to be compatible with internationally recognised Shariah standards and best practices.

The Ministry of Finance has published a robust Primary Dealers code and onboarded eight banks, namely Abu Dhabi Islamic Bank (ADIB), Dubai Islamic Bank (DIB), Abu Dhabi Commercial Bank (ADCB), Emirates NBD, First Abu Dhabi Bank (FAB), HSBC, Mashreq and Standard Chartered as Primary Dealers to participate in the T-Sukuk primary market auction and to actively develop the secondary market.

#UAE launches a dirham- denominated Islamic Treasury Sukuk (T-Sukuk), with a benchmark auction size of AED1.1 billion #WamNews https://t.co/O3QtaDDfch pic.twitter.com/S2sShNWxuM

— WAM English (@WAMNEWS_ENG) April 26, 2023

ADNOC Drilling awarded AED6.24bn contract to unlock UAE’s unconventional energy resources

ADNOC Drilling awarded AED6.24bn contract to unlock UAE’s unconventional energy resources

EHRDC offer 50 private-sector job opportunities for Emiratis

EHRDC offer 50 private-sector job opportunities for Emiratis

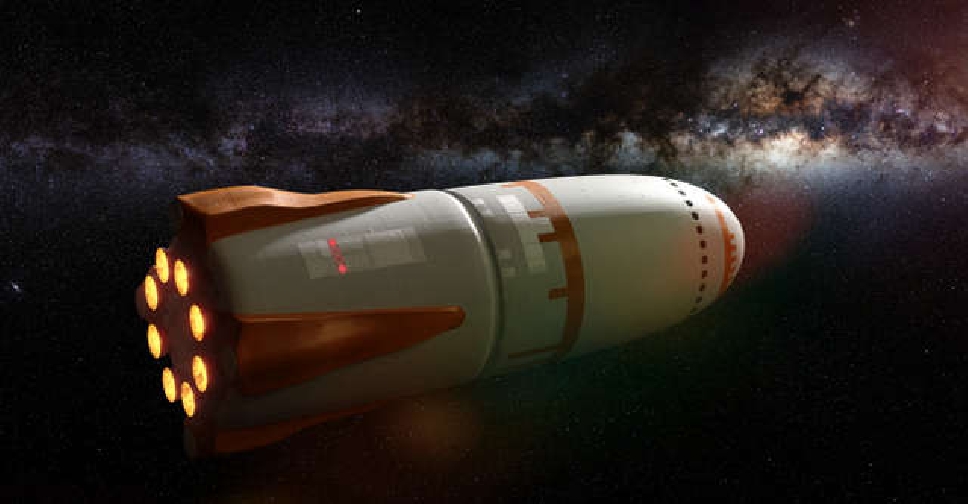

Tokyo startup to develop reusable rocket

Tokyo startup to develop reusable rocket

OpenAI strikes deal to bring Reddit content to ChatGPT

OpenAI strikes deal to bring Reddit content to ChatGPT